Liz Farr is a CPA and full-time freelance writer for the accounting profession. Her words have been in Forbes, CFO.com, Accounting Today and the Journal of Accountancy to name a few.

Liz is hoping to bring accounting into a more balanced future with her writing partnerships. We discuss how the accounting profession is moving towards automation and how if you don’t adjust you’ll be left behind. Accountants now have the opportunity to offer financial advice and clear reporting to give clients value in a new and exciting way.

Liz actually started out as a bio-chemist believe it or not. One day, to learn how to do her own taxes better, she signed up for a crash course on 1040’s. By the end, the instructor offered her a job – she took it, and went on to complete her masters in accounting and then got her CPA license. However, what drove her out of the profession and into her writing career was the same thing driving a lot of people out, too many hours and too much work.

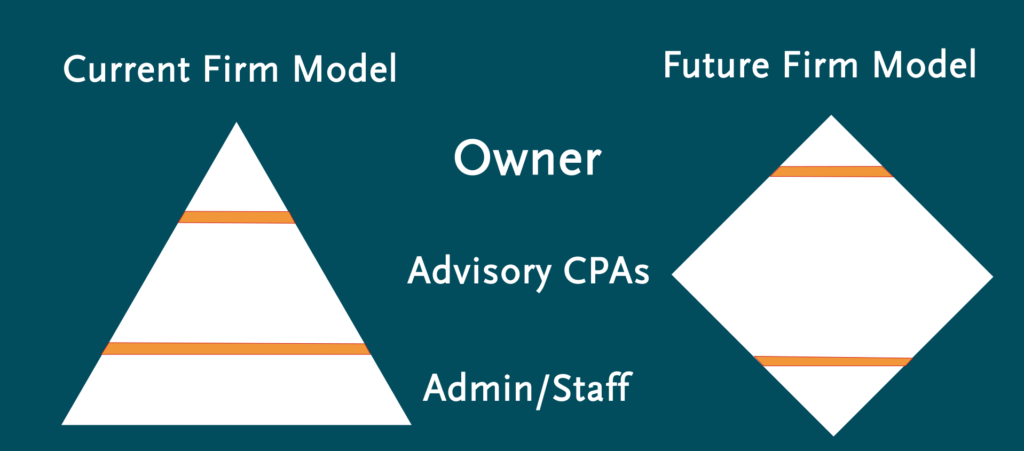

“The org chart of the future for accounting firms is not going to be a pyramid, it’s going to be a diamond shape.” We talk about how automation will reduce the size of the lower strata of admin/staff and increase the quantity and value of CPAs who can act as advisors and who “connect the dots” for their clients. The biggest message I gathered from our chat was that you can’t be afraid to move into the future and protect your biggest retirement asset, your firm.

She and I met when she reached out about wanting to do some writing with us, and she mentioned that the reason she got out of the traditional CPA side of things was because of our podcast. She had heard what Matt Wilkinson and I were discussing on the Accountant’s Flight Plan Podcast and knew that it was the future of accounting – and she wanted to be a part of creating it.

You can watch the podcast here or listen below:

Timestamps:

5:00 – Liz’s Background and Exposure to Accounting

10:00 – What prompted your career change to accounting?

12:45 – Do inject much humor into your writing?

14:45 – What’s your favorite thing to write?

15:35 – Why do you think accountants are going into the future kicking and screaming?

18:45 – How would you say that being a “niche” writer compares to being a “generalist” writer?

31:20 – What do you think will happen to these firms who are refusing to change?

35:40 – If someone has a firm that’s very traditional what could help them begin to change?

39:30 – If you were to talk to someone who is about to start a practice what advice would you give them?

42:00 – What do you see as the biggest opportunity for accountants today?

43:00 Book Recommendations:

Cal Newport – So Good They Can’t Ignore You

Profit First – Mike Michalowicz

47:00 Socials: LinkedIn | Twitter: @Liz_Farr | Liz’s Website

PS – Whenever you’re ready, here are 4 other ways we can help:

- Seller FAQ: Answers to the questions sellers are asking. From practice value, to timing, we’ve got you covered.

- Strategic Guide to Selling your CPA Practice Video: The how-to of selling a CPA firm.

- Accounting Practice Academy: If you’re looking for benchmarks, our 8-week workshop has a community of established firm owners that will help you get perspective, reduce your owner hours, and raise your bottom line. email [email protected] with “APA” and we will fill you in on the details.

- If you want to chat about your exit strategy, email [email protected] with “strategy call” or request a call here.